Antimatter Labs: Vision & Roadmap 2022

Vision

Antimatter Labs is developing option and derivatives products. Options and derivatives are highly complex financial products, which can be difficult to understand and have high barriers to entry. These kind of products often get overlooked by many users. Therefore our vision is the introduction of simplified derivatives products to serve users more conveniently. We try to use innovation and good UI/UX Design to reach a wider audience and find new growth room for our extensive Antimatter Ecosystem. Accessibility is key.

Our goal is to be the gateway of DeFi derivatives. We are early in this niche, which is still in the early stages of the Crypto & DeFi space. It goes without a say that we believe that this industry is here to stay.

Antimatter Ecosystem is structured and conceptualized to bring benefits to the Antimatter users and ultimately also for $MATTER holders.

B2

B2 is a BNB sidechain based on the BAS framework. It solves network scalability problems by having a higher output of transactions and lower gas fees. B2 is built to facilitate the financial infrastructure of the Antimatter ecosystem. The validator nodes are run by community stakeholders, bringing more flexibility and decentralization to B2.

Our next objective is to code functions that enforce the configurations & features that we envision for B2.

Whitelist system for the deployment of smart contracts onto B2

Deploy environment for launch

Listing on bnbchainlist.org with own chainId

Find sustainable bridging solution

B2 ecosystem

It is very important for us that B2 will give it’s user a great and smooth experience. That is why we want to provide tools and webpages that help the user onboard to B2.

Cross-chain bridge

Governance interface

Staking interface

$MATTER Faucet

User guides and tutorials

Lastly, we migrate all existing Antimatter DApps onto B2. This includes:

Antimatter Structured (Dual Investment, Sharkfin, ...)

Nonfungible Finance

BULL&BEAR

Products in Development

Quanto

An onchain decentralized perpetual contract in which the underlying is denominated in BNB, but the instrument itself is settled in other crypto. Essentially, a quanto has an embedded currency forward with a variable notional amount.

Tiered & Saddle Option

To add to our repertoire of Structure Products we are developing two new innovative kinds of Option Tickets. Let us introduce them

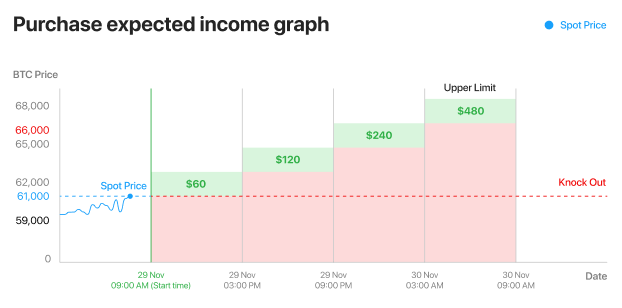

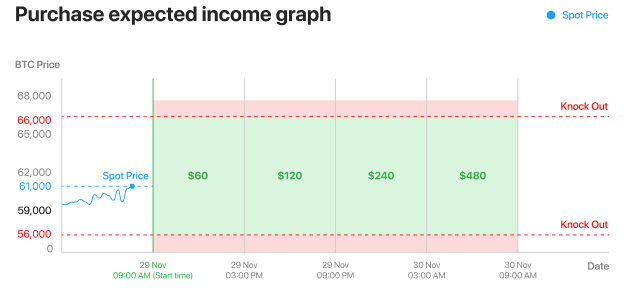

Tiered Option: In essence this product is a Call-Option, which rewards the buyer according to how many tiers he can climb without falling down. The tiers in this case are different price levels that have to be maintained to gain accumulative rewards.

Saddle Option: This product will let you bet on the volatility of an asset. The goal is to stay within a given price interval for a given amount of time. The longer you stay on the “Saddle” the more rewards you accumulate.

Ongoing Research

Metaverse

With the recent uptrend of virtual worlds, the Metaverse, we made it our task to dive in to this topic and explore the possibilities for Antimatter. We figured that building a Financial Center in the Metaverse can help promote the whole Antimatter Ecosystem. Especially Nonfungible Finance can be facilitated well through an open Metaverse, e.g. the display of your NFT Indexes.

Order Book Model

We are still in the process of researching cross-margin perpetuals with an order book model. An order book model makes it easier to onboard traditional market makers and institutions.

Accompany us on our journey, we keep building!

Last updated

Was this helpful?