Recurring Strategy

Recurring Strategy is similar to an DeFi Option Vault (DOV) following the Set-and-Forget principle. Current available strategies are based on Dual Investment products. Recurring Strategy has weekly cycles that can be cancelled before the next cycle starts.

Management Strategies

We offer two strategies for investors with BTC as underlying asset: BTC Covered Call & BTC Put Selling. The strategy algorithmically selects the optimal Strike Price for the BTC call/put options.

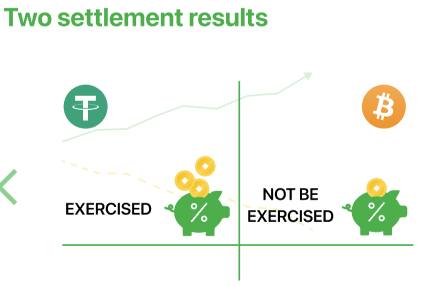

BTC Covered Call

In this strategy, the deposited funds are essentially used to subscribe to an upward exercise product. This way the strategy earns yield by running a Covered Call (What is a covered call?) that automatically covers BTC on a weekly basis. Earnings are automatically reinvested into the strategy of the settlement currency, effectively compounding the returns. The deposit currency is BTC.

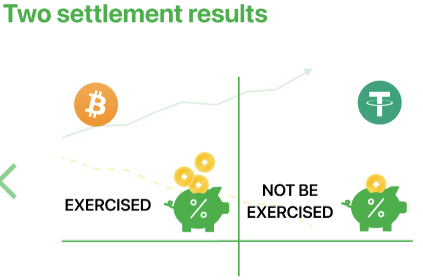

BTC Put Selling

In this strategy, the deposited funds are used to subscribe to an downward exercise product. This way the strategy earns by running Put Selling (What is put selling?) that automatically protects BTC on a weekly basis. Earnings are automatically reinvested into the strategy of the settlement currency, effectively compounding the returns. The deposit currency in this case is USDT.

Strike Selection and Expiry

The Strike Price is selected similarly to Dual Investment products:

Covered Call Strategy - Strike Price = Current Price * 105%, rounded to thousands (E.g. $51,000). The strike price would be $52,000, $53,000, and $54,000.

Put Selling Strategy - Strike Price = Current Price * 95%, rounded to thousands (E.g. $51,000). The strike price would be $50,000, $49,000, and $48,000.

The initial Strategy will run for 7 days, meaning that Strike Price is adjusted every week on Friday to minimize the risk of expiring in the money. This also allows for compounding your returns automatically

Important Mechanics

For a clear understanding it is very important to note that the strategy can change weekly depending on the outcome of the product. In case the option is exercised, the settlement currency is different from the deposited currency and therefore in the next cycle the strategy is changed to Covered Call or Put Selling respectively.

In case you don’t want to reinvest your funds if the option gets exercised, you are able to redeem your funds before the next cycle starts. This way Recurring Strategy basically still can be used as if you were running only one strategy.

Difference to Competition

Competitors like Ribbon Finance mainly run vaults with one strategy, Covered Call or Put Selling. While those kind of vaults work well when market conditions are clear, they are also vunerable to sudden market shifts.

Antimatter’s Recurring Strategy is essentially one big fund manager which simultaneously runs those two strategies. Which strategy is executed depends on the performance of BTC. The user can choose a starting point for his investment strategy: Deposit BTC for a Covered Call strategy or deposit USDT for a Put Selling strategy.

For a clear understanding it is very important to note that the strategy can change weekly depending on the outcome of the product. In case the option is exercised, the settlement currency is different from the deposited currency and therefore in the next cycle the strategy is changed to Covered Call or Put Selling respectively.

In case you don’t want to reinvest your funds if the option gets exercised, you are able to redeem your funds before the next cycle starts. This way Recurring Strategy basically still can be used as if you were running only one strategy.

Last updated

Was this helpful?